The Price of an Item is 11.49 Pounds (£). What is the Final Price if the Tax Rate is 12

Sales Tax Calculator

(*) All rates used here are for teaching purposes only.

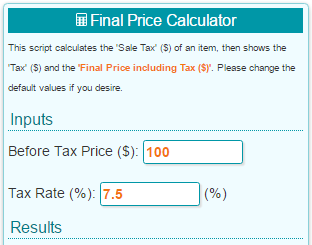

Using this calculator you can find the 'Final Price including Tax ($)' by entering the 'Sale Tax' ($) and the 'Before Tax Price ($)'. So, we think you reached us looking for answers like:

What is Final Price including Tax of an item, given: Before Tax Price = $11.49 and Sale Tax = 12 percent (%)?

What is the Tax of an item, given: Sale Tax = 12 percent (%) and Before Tax Price = $11.49?

See the solutions to these problems below.

State Sales Taxes

As of January 1, 2021(for references only)

| US State | Percent (%) |

|---|---|

| Alabama | 4.00 |

| Alaska | 0.00 |

| Arizona | 5.60 |

| Arkansas | 6.50 |

| California | 7.25 |

| Colorado | 2.90 |

| Connecticut | 6.35 |

| Delaware | 0.00 |

| D.C. | 6.00 |

| Florida | 6.00 |

| Georgia | 4.00 |

| Hawaii | 4.00 |

| Idaho | 6.00 |

| Illinois | 6.25 |

| Indiana | 7.00 |

| Iowa | 6.00 |

| Kansas | 6.50 |

| Kentucky | 6.00 |

| Louisiana | 4.45 |

| Maine | 5.50 |

| Maryland | 6.00 |

| Massachusetts | 6.25 |

| Michigan | 6.00 |

| Minnesota | 6.875 |

| Mississippi | 7.00 |

| Missouri | 4.225 |

| US State | Percent (%) |

|---|---|

| Montana | 0.00 |

| Nebraska | 5.50 |

| Nevada | 6.85 |

| New Hampshire | 0.00 |

| New Jersey | 6.625 |

| New Mexico | 5.125 |

| New York | 4.00 |

| North Carolina | 4.75 |

| North Dakota | 5.00 |

| Ohio | 5.75 |

| Oklahoma | 4.50 |

| Oregon | 0.00 |

| Pennsylvania | 6.00 |

| Rhode Island | 7.00 |

| South Carolina | 6.00 |

| South Dakota | 4.50 |

| Tennessee | 7.00 |

| Texas | 6.25 |

| Utah | 6.10 |

| Vermont | 6.00 |

| Virginia | 5.30 |

| Washington | 6.50 |

| West Virginia | 6.00 |

| Wisconsin | 5.00 |

| Wyoming | 4.00 |

How to work out sales taxes - Step by Step

Here are the solutions to the questions stated above:

1) You purchase a item for 11.49 dollars and pay 12 % (percent) in tax. How much is tax and the final retail price including tax?

- Firstly, if the tax is expressed in percent, divide the tax rate by 100. You can do this by simply moving the decimal point two spaces to the left. In this example, we do 12/100 = 0.12

-

Now, find the tax value by multiplying tax rate by the item value:

tax = 11.49 × 0.12

tax = 1.3788 -

Finally, add tax to the before tax price to get the final price including tax:

The final price including tax = 11.49 + 1.3788 = 12.8688

Sales tax Formula (Final Price)

or, if the tax is alread expressed in decimal,

2) You buy a item for 12.8688 dollars after tax was added. You know that the applicable tax rate is 12%. How much is the before tax price?

- Divide the percentage added to the original by 100. Here, a sales tax of 12 percent was added to the bill to make it 12.8688. So, divide 12 by 100 to get 0.12.

- Add one to the percentage, expressed as a decimal. In this example, add one to 0.12 to get 1.12.

- Divide the final amount by the result of the previous step to find the original amount before the percentage was added. In this example, divide 12.8688 by 1.12 to find the amount before the sales tax was added, which equals 11.49.

Sales tax Formula (Before Tax Price)

or, if the tax is alread expressed in decimal,

To find more examples, just choose one at the bottom of this page

More about sale taxes

Tax rates vary widely by jurisdiction and range from less than 1% to over 10%. Tax is collected by the seller at the time of sale. A sales tax is imposed at the retail level. In cases where items are sold at retail more than once, such as used cars, the sales tax can be charged on the same item indefinitely. To determine the (total) tax rate you should identify the total amount of tax you must charge. If, for example, a state has a two percent tax rate, a given county two percent and a city one percent, the total tax rate applicable is five percent: 2 + 2 + 1 = 5.

Sales Tax Calculator

Please link to this page! Just right click on the above image, choose copy link address, then past it in your HTML.

Sample Sales Tax Calculations

Disclaimer

While every effort is made to ensure the accuracy of the information provided on this website, neither this website nor its authors are responsible for any errors or omissions. Therefore, the contents of this site are not suitable for any use involving risk to health, finances or property.