After a period of 1

Compound interest means that the interest you earn each year is added to your principal, so that the balance doesn't merely grow, it grows at an increasing rate. Click here to read more about interest rates.

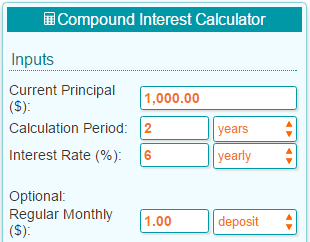

Compound Interest Chart

Compound Interest Calculations Table

Compound Interest Meaning

Compound interest means that the interest you earn in each compounding period is added to your principal, so that the balance doesn't merely grow, it grows at an increasing rate.

Compound Interest Formula

Where:

- A = the future value (or FV) of the investment/loan, including interest

- P = the principal investment amount (the initial deposit or loan amount also known as present value or PV)

- r = the annual interest rate expressed in decimal form (decimal = %/100). r is also known as rate of return.

- n = the number compounding periods per year (n = 1 for annually, n = 12 for monthly, etc.)

- t = the time in years or fraction of years (multiples of 1/n. Ex.: 2/n, 3/n, etc.)

If you want to calculate the compound interest only, you should use this formula:

Notes:

- This calculator uses one year as 365 days.

- This calculator is provided to help you determine how a line of credit, loan, savings account or a deposit may affect your budget.

See Also:

References

Compounding Interest Calculator - Yearly, Monthly, Daily

Please link to this page! Just right click on the above image, choose copy link address, then past it in your HTML.